Annexes

Información adicional del Admin portal Credit card

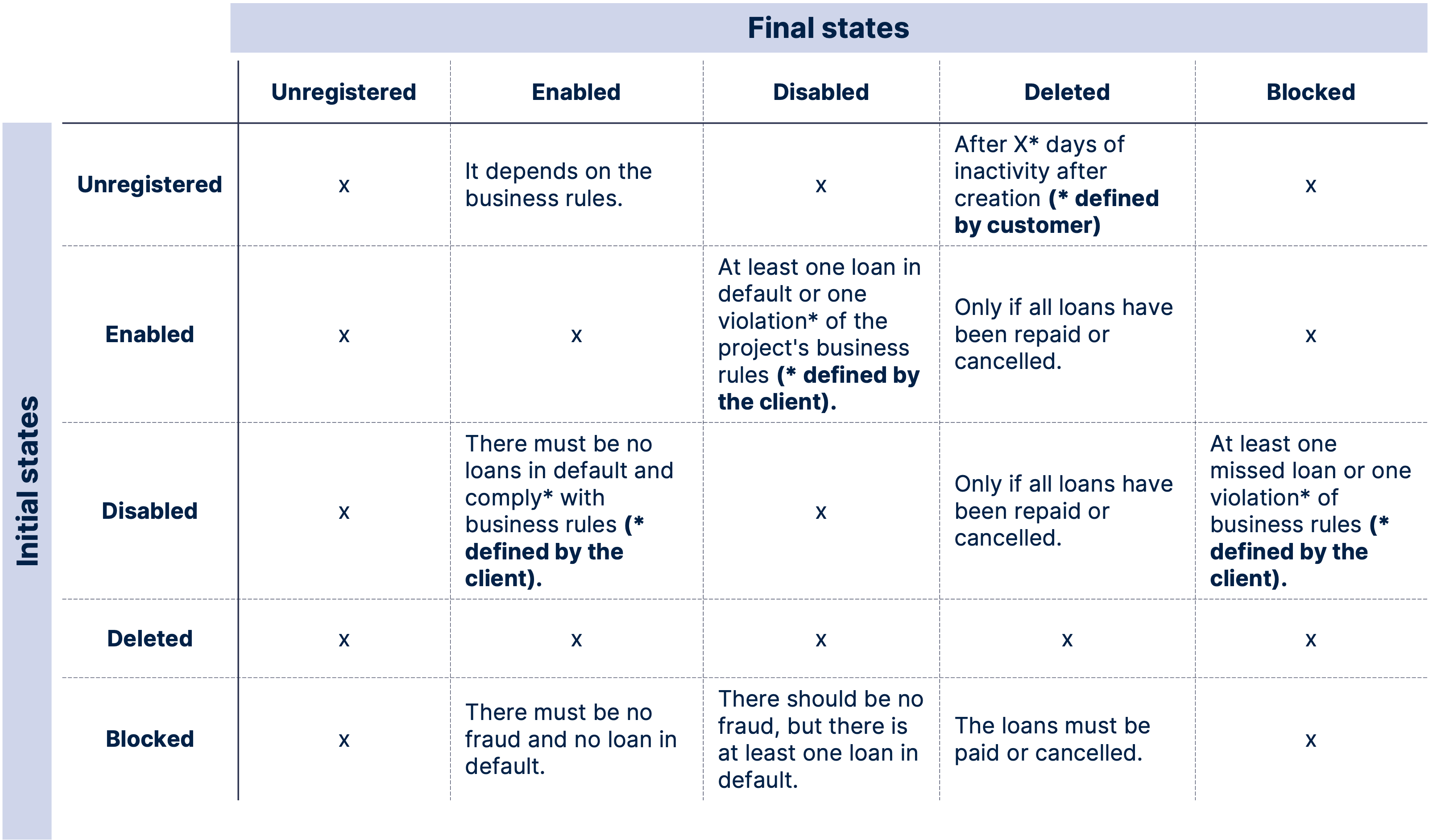

Definition Customers status

Unregistered: First automatic status of each user. In this status the user has not yet completed the registration process.

- Allowed actions: finish the registration process through the platform.

Enabled: Proactive status that only applies when the customer is eligible to apply for credit. It is found with credits free of arrears, canceled or has not committed violations to the business rules.

- Actions allowed: make payments (automatic and voluntary) and requests for new loans through the platform.

Disabled: Automatic status in which the customer is disabled to make new credit requests, because he has at least one delinquent credit or has committed violations to the business rules.

- Actions allowed: make payments (automatic and voluntary) through the platform.

Deleted: Proactive status where user information is permanently obfuscated from the platform. Obfuscated information: Names and Surnames, Phone Number, E-mail, Address, National ID.

- Actions allowed: No actions allowed

Blocked: Automatic state where the user is not allowed to make new loan requests within the platform. The user's information remains stored in the platform and available for consultation.

- Actions allowed: payments outside the platform.

Status conditionals

Definition of credit status: Preloan - Authorizations / Loans - settlements

Pre-Loans – Authorizations:

Pending: first automatic status of each application. The loan has not yet been confirmed.

Rejected: the loan has not been approved. Terminates the process.

Completed: the application was confirmed and becomes an active loan.

Loans – Settlements:

Active: automatic status where the disbursement has already been made and the user is not in arrears or in violation of business rules.

- Actions allowed: making automatic and voluntary payments through the platform.

In Dispute: State where a transaction or charge is under dispute by the customer.

- Actions allowed: No actions allowed.

Paid: Automatic status where the loan is closed because the user has completed the loan repayment plan.

- Actions allowed: No actions allowed.

Cancelled: proactive status where the loan is paid off, no interest or additional fees are incurred.

- Actions allowed: No actions allowed.

Status conditionals

Payment Statements Definition: Pre-Payments & Payments

Pre-Payments:

Pending: First automatic status of each payment. The payment has not been confirmed yet.

Rejected: The payment was not approved. Terminates the process.

Completed: The payment was confirmed and becomes an accepted payment.

Payments:

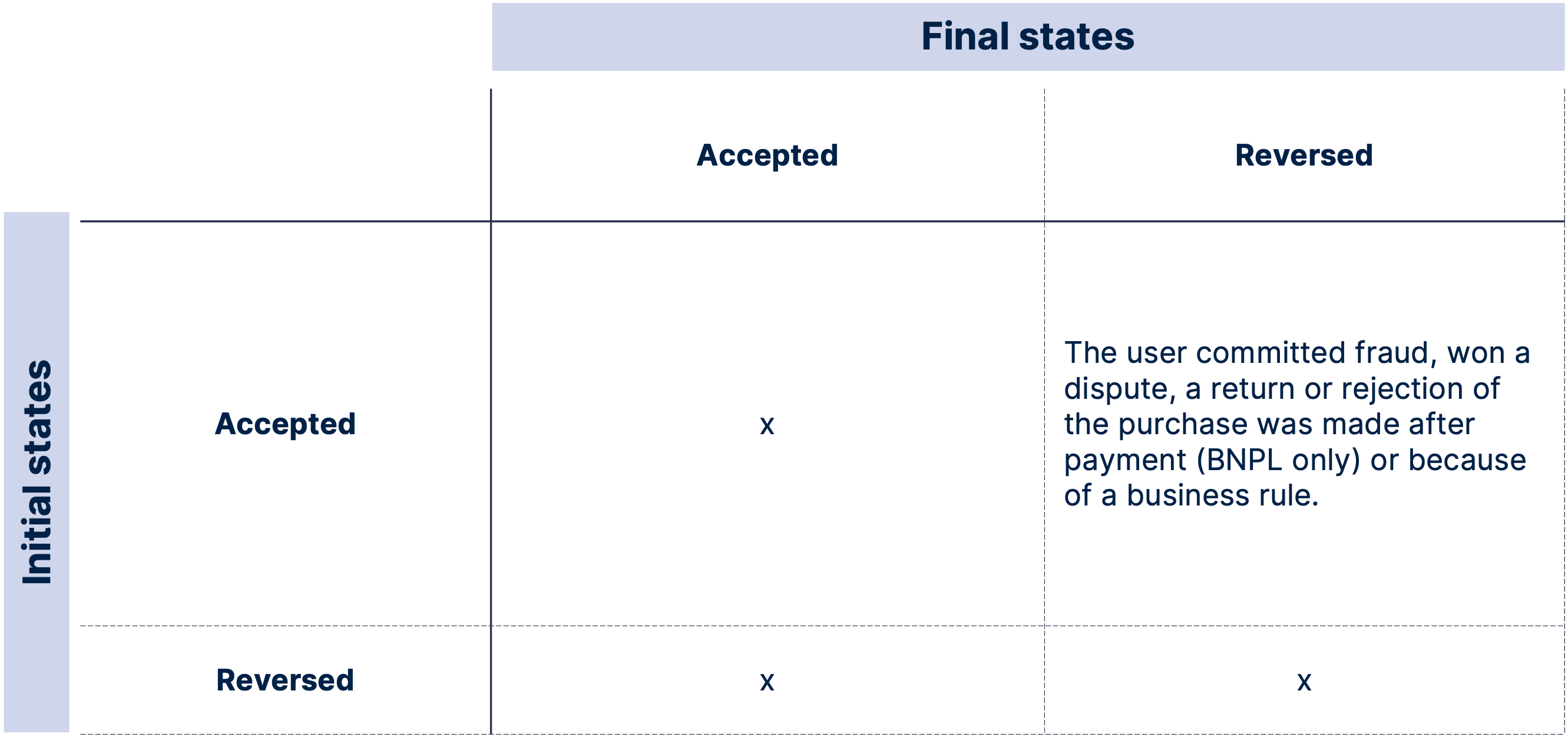

Accepted: Automatic status where the payment was successfully made and applied to the outstanding loan balance.

- Actions allowed: No actions allowed.

Reversed: Proactive status where the payment is returned to the user because the user committed fraud, won a dispute, a refund or rejection of the purchase was made after payment or because of a business rule.

- Actions allowed: No actions allowed.

Status conditionals

Definition Product Catalogue states

Product:

Enabled-Active: The product was successfully created and is enabled to add offers within this product.

Inactive: The product was removed from the platform; however, the information is still stored on the platform. All charges, payments and promises to pay are stopped. No new offers can be added, or loans issued from this product.

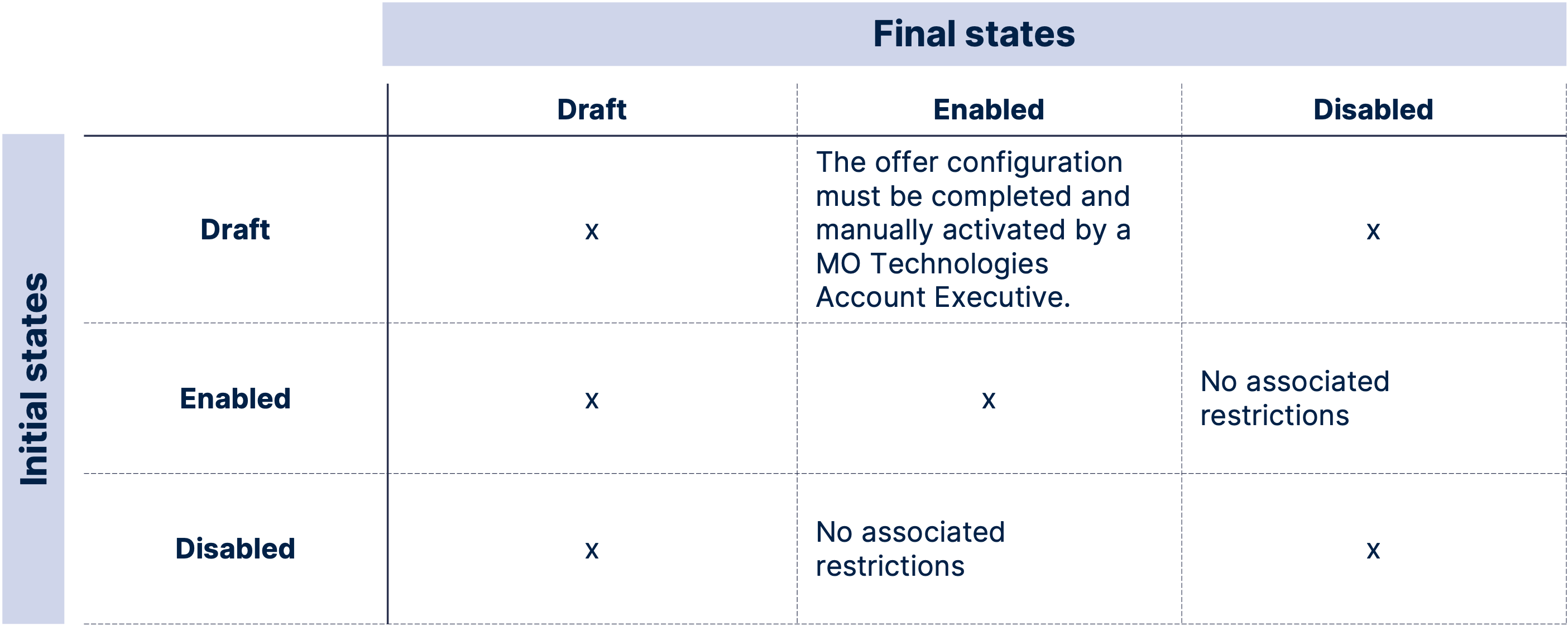

Offer:

Draft: Automatic status where the offer needs to be fully configured and manually activated by a MO Technologies Account Executive.

- Actions allowed: Manual activation by an Account Executive.

Enabled-Active: Automatic status where the offer has been successfully activated and is ready to issue loans.

Tags :

- In use: At least one active loan.

- Idle: No active loans yet.

Actions allowed: Modification (allowed depending on the project) or elimination of the offer with the assistance of the Account Executive.

Disabled-Inactive: Proactive status where the offer is disabled for the application of new loans.

Tags:

- In use: At least one active loan

- Idle: No active loans yet.

Actions allowed: users can make automatic and voluntary payments.

Status conditionals

Definition of Account card status

Account Card:

Active: The account was successfully created and is enabled.

Suspended: The account was suspended for not meeting the minimum payment in a cycle; however, the information is still stored in the account. Fees, payments and promises to pay are still being applied. No new transactions can be made with any credit card associated with the account.

Canceled: The account was canceled on the platform; however, the information is still stored on the platform. No new transactions can be made with any credit card associated with the account.

Definition Card Status

Card Status:

Default: The card is inactive; however, the information is stored in the platform. No transactions can be performed.

Active: The card was successfully activated and is enabled for transactions.

Suspended: The card was suspended on the platform, however, charges, payments and promises to pay are still being applied. No new transactions can be made with the suspended credit card.

Blocked: The card is blocked on the platform and can be blocked from the App or the End point. No new transactions can be made with the blocked credit card.

Canceled: Status where the card is canceled on the platform, to cancel the card must have no outstanding debt or credit balance. No interest or additional charges are generated.

Stolen: Status where The card was reported as stolen, however, fees, payments and promises to pay are still being applied. No transactions can be made with the card.

Lost: State where the card is reported as lost. However, fees, payments and promises to pay still apply. No card transactions can be made.

Updated 4 months ago