Overview

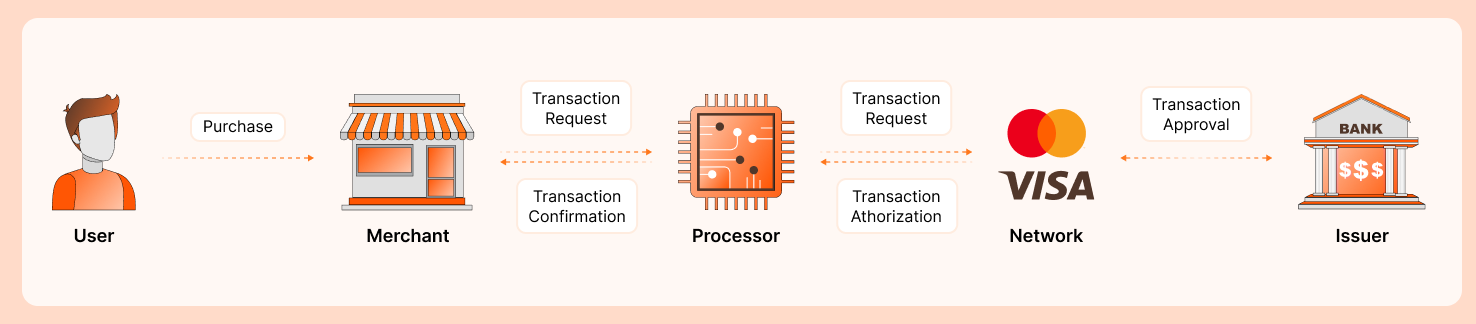

In the traditional realm of credit card transactions, a complex network of at least five entities comes into play. The cardholder, the merchant, an acquiring/transaction processing network, a payment network (e.g., VISA, MasterCard), and the issuing bank of the credit card. The flowchart below provides a simplified example of how a transaction is processed and authorized within this traditional credit card model.

MO's Innovative Solution

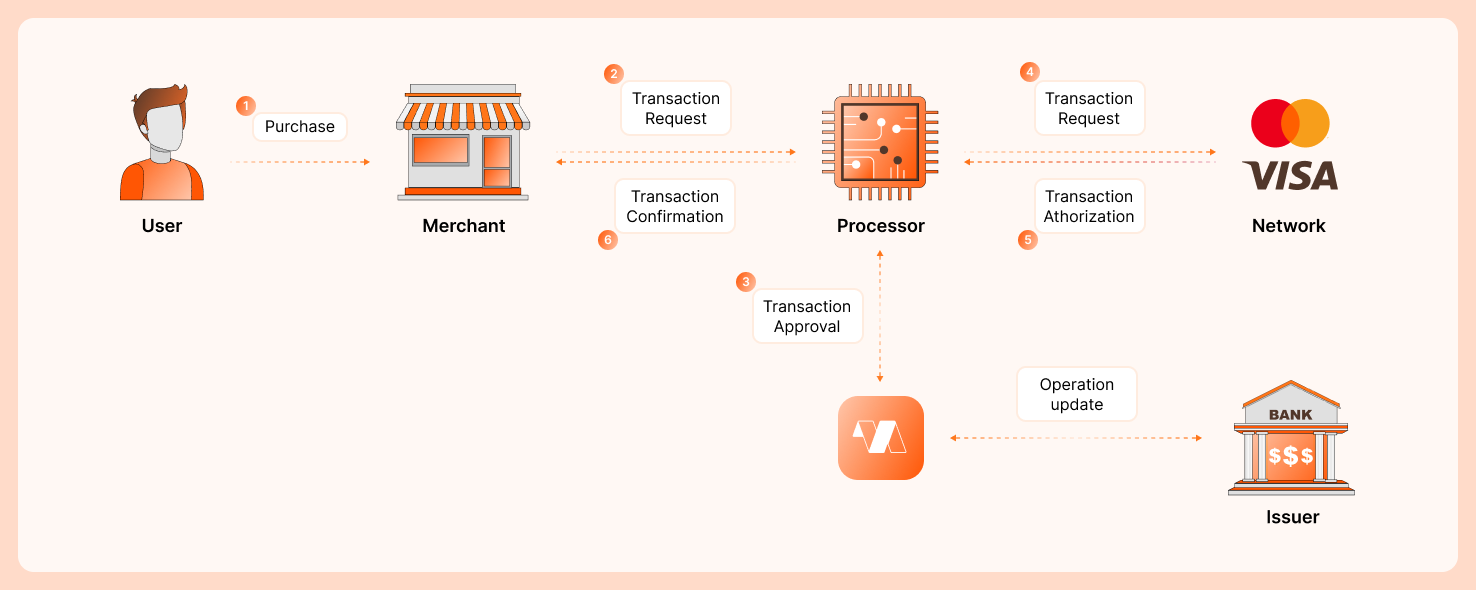

MO's credit card management system offers a revolutionary approach that empowers any issuer to streamline the process of launching a credit card product. This comprehensive solution encompasses various tasks, including creating and updating offers, managing loan logic, and overseeing credit card accounts. This breakthrough allows new card issuers, who may lack an in-house credit card management engine, to enter the market and compete with tailored offers, all without the need for extensive internal development efforts to initiate operations.

The diagram below illustrates the simplified process of a credit card transaction when MO is involved. MO efficiently approves the transaction based on business rules defined by the issuer, such as credit limits, overdrafts, and other customized criteria.

Ledger management or lending core

To set up loan products, you need to create loan product configurations that include all the essential parameters, such as amortization methods, interest rates, fees, and terms. To keep track of the loan products, you should maintain and update the loan records in the ledger by processing payments, refinancing the loan, or making other necessary adjustments as required.

CRM (Customer Relationship Management)

You can get a complete overview of your loan portfolio by using a portal or issuer interface that is integrated with the ledger. This will give you a consolidated view of your loans based on batch, segment, or other groups. You can access detailed information about your customers, including their loan products, payments, and transaction-level details of your operations. Additionally, you can leverage self-service administrative features that allow users to create new loans, update customer information, or make changes to existing loans.

Repayment engine

Receive and process payments from borrowers and update the balance of the loan or loans in the ledger. It is important to define the logic to determine how payments are applied to specific loans when payments are not explicitly directed to a particular loan due to repayment gateway limitations. Additionally, the process should specify how payments are distributed within a loan entity, considering various factors such as the loan balance, fees, interest, default interest, and more.

Disbursement engine

When a loan is confirmed in the system, disbursements or enablement should be initiated through API triggers such as calls to a disbursement gateway or compensation process managed by the payment processor.

Omni-channel communications

Establish ongoing and multichannel communication with borrowers throughout the loan lifecycle. Automatically trigger communications at key points in the loan lifecycle to ensure an optimal user experience and encourage desired loan payment behavior.

These components collectively form a robust system for managing loans, enhancing customer relationships, and ensuring smooth loan operations.

Updated 4 months ago